A $1.7 Trillion Rally Pushes Korea Market Cap Above Germany’s.

South Korea overtook Germany in stock market value, powered by tech giants riding the global boom in artificial intelligence and robotics.

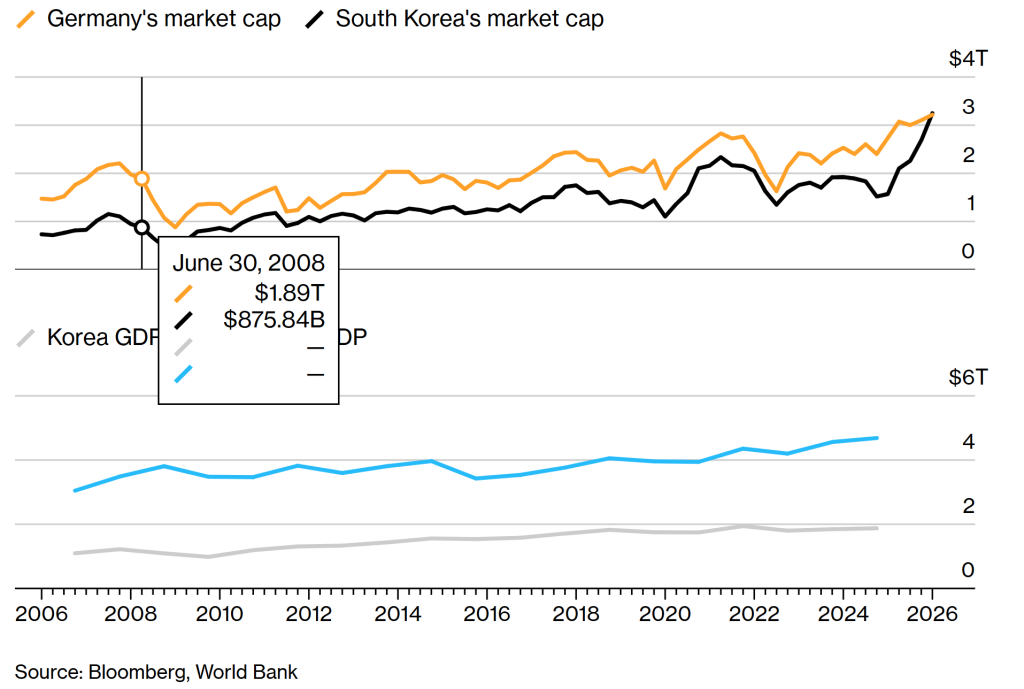

The Asian nation’s stock market climbed to a valuation of $3.25 trillion, after adding roughly $1.7 trillion since the start of 2025, according to Bloomberg-compiled data as of Wednesday. That surpassed Germany’s $3.22 trillion, making Korea the world’s 10th‑largest stock market, just behind Taiwan.

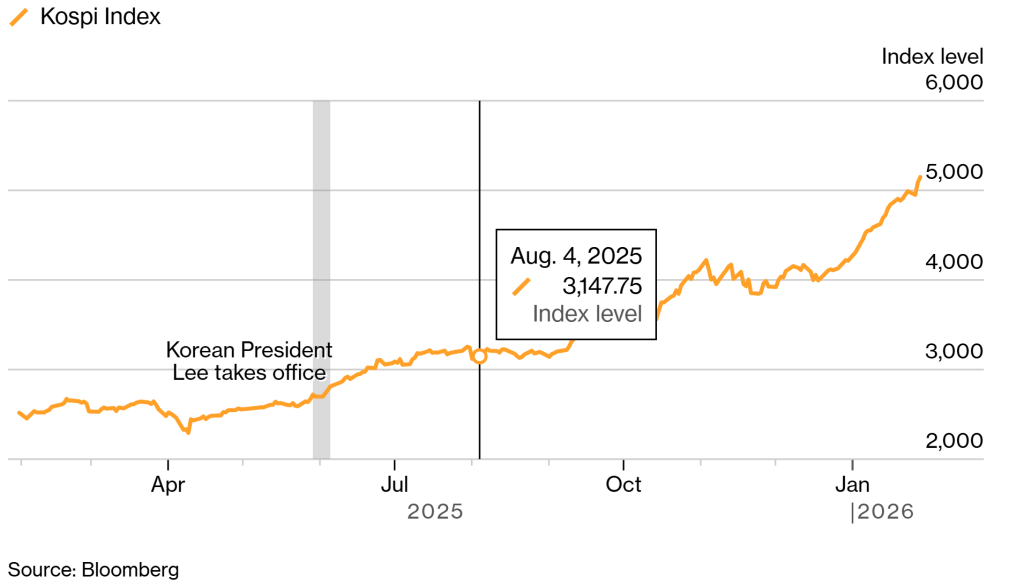

The reshuffling in rankings highlights the swift rise of Korean stocks, driven by shareholder‑friendly reforms and the nation’s pivotal role in the global AI supply chain. The equity benchmark Kospi has jumped 23% in 2026, while Germany’s Dax Index has climbed just 1.7%, weighed down by geopolitical uncertainties and a lack of clarity over stimulus deployment

“Korea is no longer just a proxy for global trade; it is the only market currently positioned at the bottleneck of the three most critical megatrends of the 2020s: AI, electrification, and defense,” said Keith Bortoluzzi, managing director at Singapore-based Impactfull Partners. Germany’s earnings are grappling with a secular decline in autos and chemicals, while Korea is enjoying a supercycle fueled by rearmament and AI infrastructure.

Korea’s Market Cap Overtakes Germany’s

Overall size of economy remains considerably smaller

Korean President Lee Jae Myung’s vocal support for the stock market and push for corporate governance reforms helped ignite last year’s rally. The drive coincided with supply shortages and price hikes in memory chips, which led to sharp gains in Samsung Electronics Co. and SK Hynix Inc. The robotics boom has also sparked epic gains in Hyundai Motor Co. and its affiliates. Momentum carried the benchmark past the 5,000 mark for the first time last week.

Korean stocks are still cheap, with the Kospi Index trading at 10.6 times forward earnings estimates, compared to Germany’s benchmark at 16.5, according to Bloomberg-compiled data.

Despite Korea’s catch-up in market cap, the two economies remain far apart in size. In 2024, Korea ranked 12th globally on gross domestic product, while Germany held the third‑place position, according to World Bank data. Europe’s largest economy was about 2.5 times bigger at roughly $4.69 trillion versus $1.88 trillion.

The gap between Korea’s stock market and its real economy reflects a structural divide between export-led corporate profits and weak domestic demand, said Jeong-Woo Park, an economist at Nomura Holdings. While most Kospi-listed companies earn primarily from exports, the broader economy relies more on consumption and construction, where activity has lagged.

Changing Trajectory

The Kospi’s trajectory moved ahead of Germany’s benchmark DAX Index last year as hopes for a swift stimulus in Europe’s largest economy faded. The tech sector’s dominance in Korea — accounting for about 40% of Kospi’s weighting — also helped, while industrial and defense companies are big players in the DAX Index.

Korea’s Rally Keeps Breaking Records

Among Germany’s leading gainers this year are pharmaceutical conglomerate Bayer AG, Siemens Energy AG, and defense contractor Rheinmetall AG.

“We entered the year with much more hesitation,” said Dominic Traut, a portfolio manager at Julius Baer, noting the market has become more realistic about the stimulus impact.

Source: Bloomberg, By Youkyung Lee, Nick Heubeck, and Sangmi Cha.